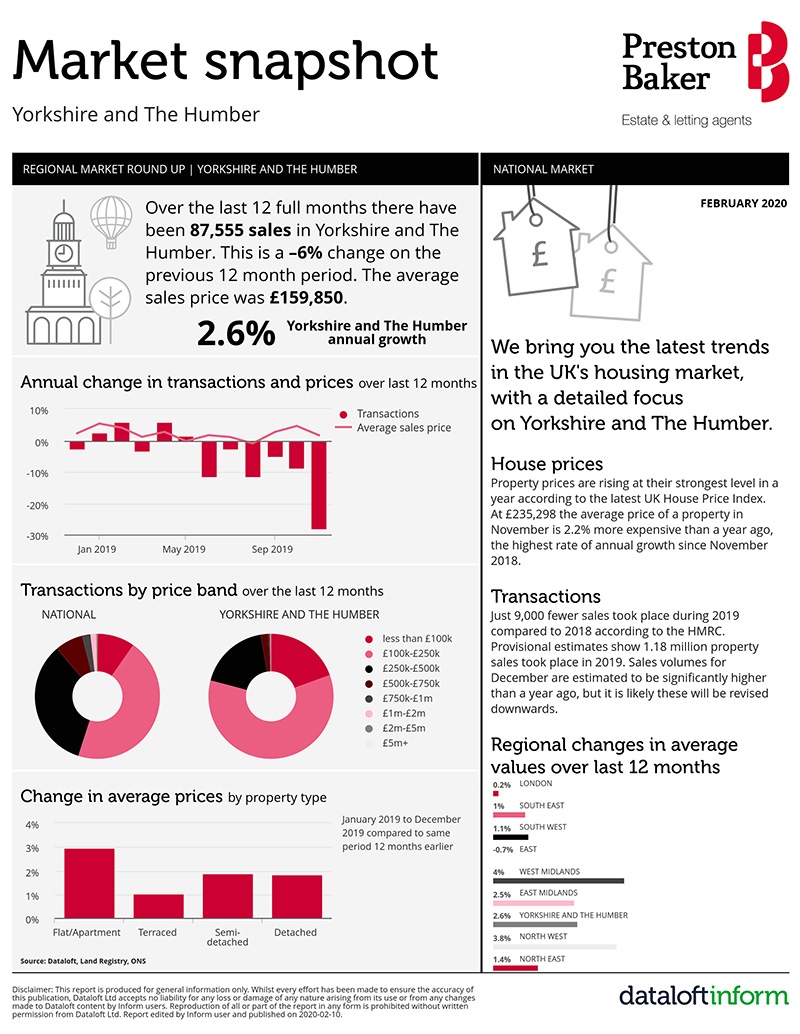

The Housing Market for Yorkshire and The Humber has weathered well through all the uncertainty surrounding brexit, and is one of the fastest growing regions in the UK.

Yorkshire Housing Market

We pride ourselves on providing up-to-date market driven insight into all aspects of Estate Agency. Knowledge is power, but we don't keep that knowledge to ourselves, we share it with you. If you'd like a more localised update on the housing market in your area, please get in touch, or visit the links below this report.

For a more localised view on the Housing Market in your area click on one of the locations below.

Need more assistance?

Visit our branch pages to speak to one of our local property experts

Preston Baker Branches